Canadians keep falling for Nigerian letter scam

Updated Sat. Jul. 4 2009 11:05 AM ET

The Canadian Press

TORONTO — Fraud artists are finding it easier amid a battered economy to entrap marks with dubious offers once easily dismissed as scams, and are snaring a growing number of victims to the tune of millions of dollars a month, experts say.

The Competition Bureau is warning that recessions are “boom times for scammers” and predicts desperate Canadians will fall into traps offering easy cash online, by phone and mail.

Statistics provided by Phonebusters — the Canadian anti-fraud call centre run by the Royal Canadian Mounted Police, the Competition Bureau and Ontario Provincial Police — show Canadians are increasingly falling prey to scams of all types.

“Fraud does tend to increase in economic downturns,” said Ian Nielsen-Jones, the Competition Bureau’s assistant deputy commissioner.

Vulnerable people sometimes lower their defences and make bad decisions as times get tough, while others on the borderline of lawful society turn to crime, Nielsen-Jones said.

Scams involving promises of employment are on the rise, while other ploys that had virtually disappeared because the public had gotten wise to the ruse are now making a comeback, he added.

“We used to say that lottery scams had pretty much gone away,” Nielsen-Jones said.

“Well they’ve come back again and I think they’ve come back again because of the economic downturn.”

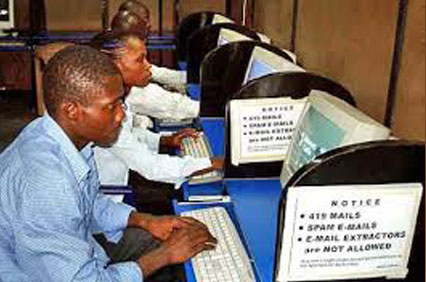

Even the most outlandish scams continue to be successful. Among those is the so-called Nigerian letter scam, which typically offers too-good-to-be true promises of untold millions from an African country in exchange for some simple help with a few bank transactions.

The offer — which is usually passed along in broken English and riddled with grammatical errors — sees most Internet users simply hit delete. Still, an average of 10 Canadians each month continue to fall for it and get soaked for as much as hundreds of thousands of dollars.

June was a relatively slow month for victims of the letter scam in Canada, with four people reporting losses of a total of almost $73,000.

But in May, 11 Canadians fell for the letter scam and were taken for a total of almost $571,000, while a U.S. victim reported they lost $200,000 in a scam with Canadian links.

“Is it greed? I don’t think so. Is it pure ignorance? Maybe. Is it possible that the Canadian citizens are not well informed?” said Cpl. Louis Robertson, a spokesman for Phonebusters.

“Why does it work? I don’t know. I’ve been with the RCMP for 21 years and I’m still looking at the same email messages — and they still work.”

But the millions lost in letter scams are just a drop in the bucket compared to losses from identify theft and mass-marketing fraud, which covers a vast array of online and telephone scams. That includes bogus offers about investment opportunities, prizes and lottery winnings, and inheritance claims.

More than 1,000 Canadians contact Phonebusters every month after being victimized by identify theft and through June 30 of this year, almost 6,700 complained they’d lost about $5.2 million.

Last year, more than 11,000 victims reported more than $9.6 million in losses.

In 2008, about 57 per cent of the 14,201 victims of mass-marketing scams with Canadian connections were from other countries, while the percentage was about 67 per cent in 2007.

In the first six months of the year, Phonebusters has heard from more than 7,000 mass-marketing fraud victims, including 3,903 Canadians, with losses totaling almost $26.5 million.

And Nielsen-Jones said those numbers only scratch the surface, since authorities usually only hear from victims who have lost a lot of money. Many who get taken for $100 or less don’t bother reporting they’ve been scammed.

“I’d be willing to say you could take those numbers and multiply them by 10 in terms of the actual attempted victimizations,” he said.

“The truth is we believe that somewhere between five and 10 per cent of people who have been victimized, or almost victimized, phone into law enforcement.”

Usually authorities only track and investigate scams that involve larger losses but the Competition Bureau is currently looking into a phoney employment opportunity scam that may have defrauded around 10,000 people out of around $50.

“I don’t mean to demean (small) losses but we have bigger fish to fry. But when there’s that many victims, it’s time for law enforcement to step in,” Nielsen-Jones said.

For victims who call Phonebusters hoping they might get their money back, the answer isn’t reassuring.

“First of all, are we going to actually find the perpetrator, are we going to actually bring the perpetuator to justice, and is the court going to order restitution?” Nielsen-Jones said.

“We do the best we can but we don’t promise that we’re able to (recover money) as a sort of a normal course of events.”